Trucking drives $144.8 billion in cross-border trade, led by key ports like Laredo and Detroit

June 5, 2025 – Washington, D.C.

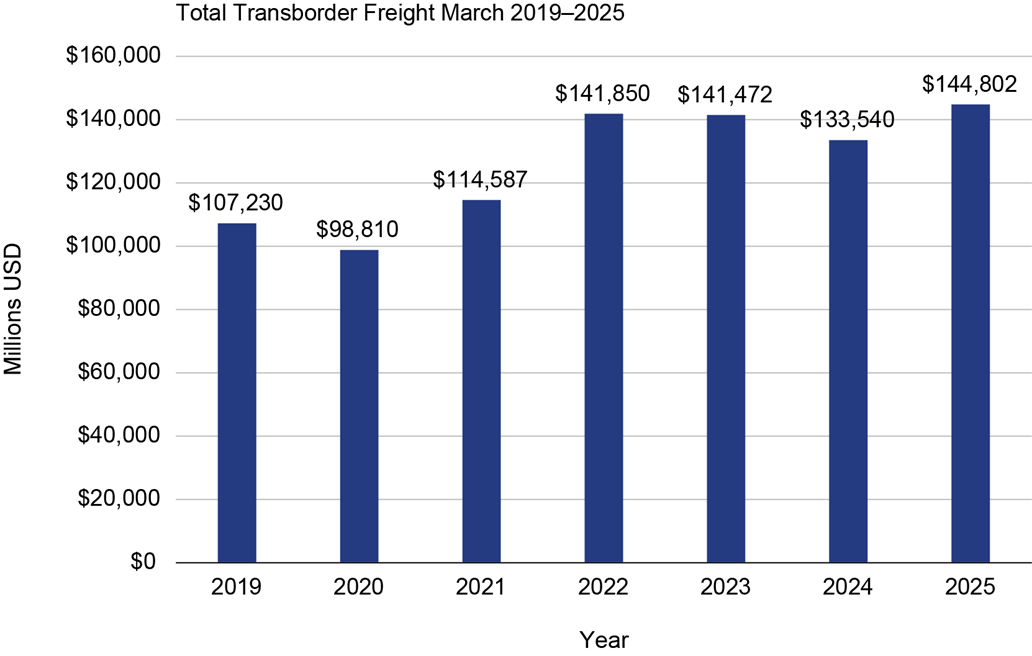

Cross-border trade between the United States, Canada, and Mexico hit an all-time monthly record in March 2025, with freight shipments totaling over $144.8 billion, according to the Bureau of Transportation Statistics (BTS). The figure represents an 8.4% increase from March 2024 and a 35% jump from the pre-pandemic benchmark of March 2019.

The March milestone underscores the growing scale and strategic importance of the North American freight network. In 2024, the total annual freight volume between the U.S., Canada, and Mexico reached $1.6 trillion, marking a 1.8% year-over-year increase.

Trucks Move the Majority of Goods

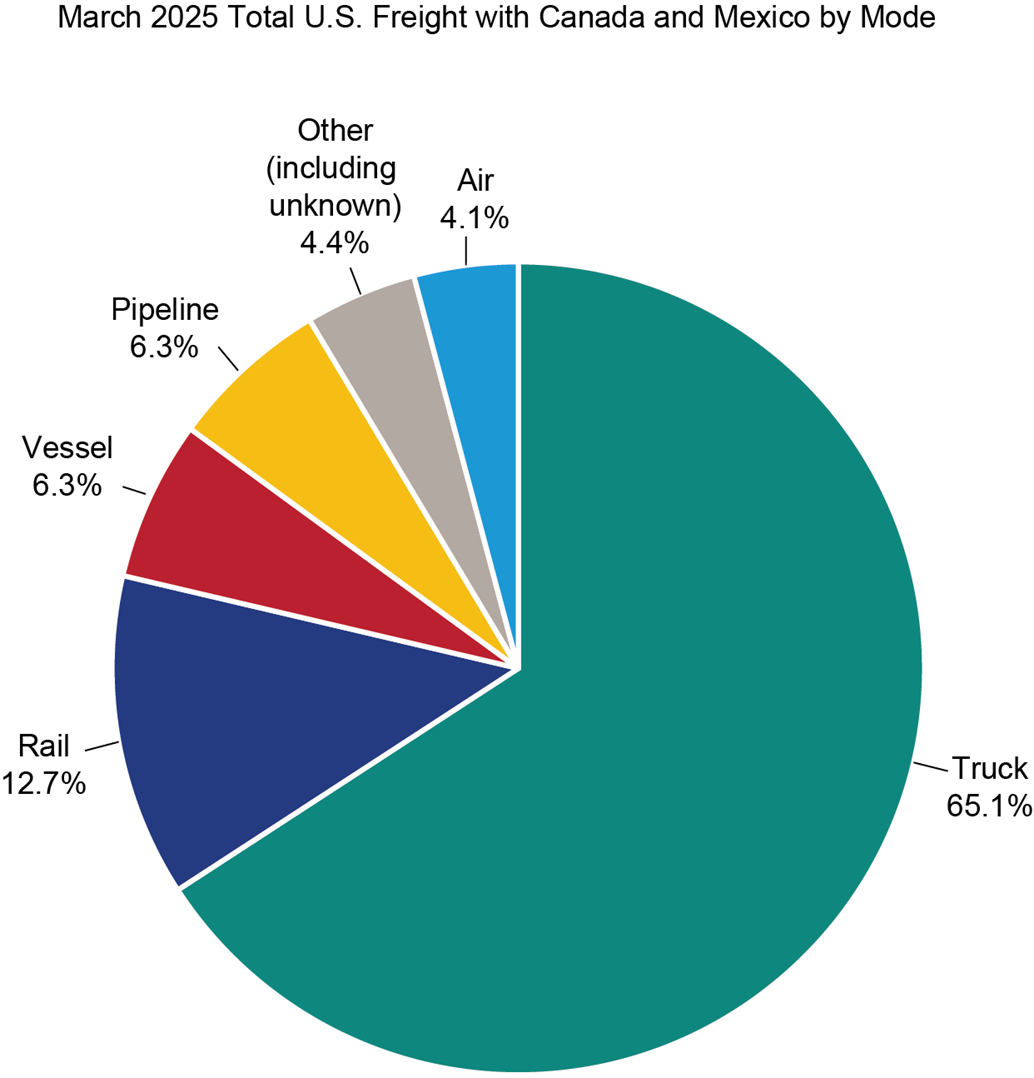

Among all modes of transportation, trucking remained dominant, accounting for over $94.2 billion in freight movement during the month—up 9.5% from the previous year. That includes $67.5 billion in trade with Canada and $77.3 billion with Mexico.

Trucking currently handles more than 60% of all surface trade between the U.S. and its northern and southern neighbors, thanks to its flexibility, direct routes, and faster delivery times compared to rail or sea freight.

“North America’s interconnected road network allows for seamless intermodal transfers, reducing transit times and costs while improving inventory control,” the report notes. “This is a key advantage for both manufacturers and retailers.”

Laredo and Detroit Among Top Gateways

Several land ports of entry continue to play outsized roles in managing freight volume. Laredo, Texas, one of the busiest gateways with Mexico, handled $30.5 billion in shipments in March alone, reflecting 12.4% growth from March 2024. Its strategic location connects major industrial centers such as Monterrey and Guadalajara with U.S. markets, bolstered by critical infrastructure including international bridges, customs preclearance zones, and extensive highway and rail links.

Meanwhile, Detroit, Michigan remains a major hub for U.S.-Canada trade, thanks to its proximity to manufacturing-heavy regions in Ontario and the Midwest.

Electronics and Auto Parts Lead Trade Volume

Key commodities driving cross-border trade include:

- Electronics (e.g., semiconductors and computer equipment)

- Automotive parts, including transmissions and engines

- Machinery and mechanical components

These products often crisscross borders multiple times before reaching their final destination. A typical example: a transmission might be designed in Japan, cast in China, assembled in Mexico, and installed in the U.S.—illustrating the highly integrated nature of global supply chains.

About the Data

The statistics come from BTS’s TransBorder Freight Data Program, which tracks U.S. imports and exports with Canada and Mexico by transportation mode, commodity type, and port of entry. This data supports trade corridor studies, infrastructure planning, and logistics analysis across the continent.

For interactive dashboards, raw datasets, and additional documentation, visit the BTS portal at data.bts.gov/stories/s/kijm-95mr.